Today: a teacher who makes $54,000 per year and spends some of her money this week on Lulu’s heels.

Occupation: Teacher

Industry: Education

Age: 26

Location: Springfield, MA

Salary: $54,000

Net Worth: ~$47,000 (I have $47,000 between my checking and savings account, $1,076 in a CD at Chase that I started in high school, and a little over $10,000 in a Roth IRA account from Fidelity, minus debt. My fiancé and I just got engaged, so no shared accounts yet, but we will probably make a joint account once we are married. We use Venmo a lot to share expenses.)

Debt: $11,000 car loan

Paycheck Amount (2x/month): $1,411

Pronouns: She/her

Monthly Expenses

Rent: $700, which includes utilities (We pay $2,100 split three ways to live in the house my fiancé, B., bought last year. Third roommate is B.’s brother.)

Car Payment: $265

Savings: $500

Cell Phone: Still on the family plan for my phone (Thanks mom!)

Health Insurance: $85.95 (pre-tax)

Dental Insurance: $3.86 (pre-tax)

Union Dues: $42 (pre-tax)

Retirement: $226.33 (pre-tax)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, there was. Neither of my parents graduated from college. My dad never got to go because he had to work at the family business and my mom just never finished. They pushed for my siblings and me to attend college. They were very generous and paid for whatever scholarships didn’t cover. I went to grad school where I went to undergrad and they paid for my education in full because I helped teach classes and was an assistant coach for the field hockey team. I was able to graduate with no student debt! I realize how lucky I am to be in this situation.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I don’t remember talking much about money growing up besides saving birthday money that I got. When I was in high school my parents helped me open a savings account and credit card to start my credit score. I didn’t use it much, but it was helpful to have. I wish I had asked my dad more about investments and whatnot before he passed away, since he was always the money guy.

What was your first job and why did you get it?

My first job was going to work with my dad. Other than that I did a lot of babysitting to have spending money and to save for a car.

Did you worry about money growing up?

Not really. Some years over the winter when my dad’s business was slow I’d hear my parents talk about spending less, but I didn’t worry. We always went on family vacations out of the country twice a year, did any extracurriculars we wanted, and were able to get what we needed without having to worry.

Do you worry about money now?

A bit, yes. I know I have a good job and not a lot of expenses to worry about but I think about money in terms of how to best invest it and how to increase it for the future. I had a great childhood, and if we have kids, I would like to give them a good childhood and not have to worry about money.

At what age did you become financially responsible for yourself and do you have a financial safety net?

When I graduated from graduate school at 24. After that, I got a full-time job and started paying for everything. My mom would help out if I needed it and B.’s dad would help as well.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, I received $8,000 when my dad passed away.

Day One

6 a.m. — Friday! My fiancé, B., and I wake up to our alarm and cuddle in bed before he gets up to shower and I get dressed. We work at the same school, so we are up at the same time each day. I get dressed, brush my teeth, grab my lunch, and we head out the door.

12 p.m. — Lunchtime! Pretty easy day so far, other than the fight I had in one of my classes. Middle school is s tough time for a lot of kids and they don’t always know how to regulate their emotions properly. We’re working on it. During lunch, I browse online for a new hand towel to match our freshly painted bathroom that B. did a few days ago. I find one that looks good and order it. $17

3:05 p.m. — End of the school week! My mom, brother, and B.’s sister are coming for the weekend so I run to our favorite Italian restaurant and pick up a salad that will go with the pasta and meatballs my mom made. I then run home to freshen up the house a bit and hang with B. before our guests arrive. $30

6 p.m. — The team I help coach has a game tonight and my family and B. come to watch. We win! My mom and brother always loved watching my games in high school and college when I played, so I’m glad they’re here tonight and get to see a win.

8 p.m. — We finally get back to the house to eat a late dinner and it is delicious! We eat, laugh, and talk throughout dinner and dessert. After dinner, we play some Catan, which B. taught us how to play at the beginning of COVID. We love this game so much, it really got us through quarantine. We have a leaderboard for Catan wins and I am currently at the top. I hope to extend my lead this weekend.

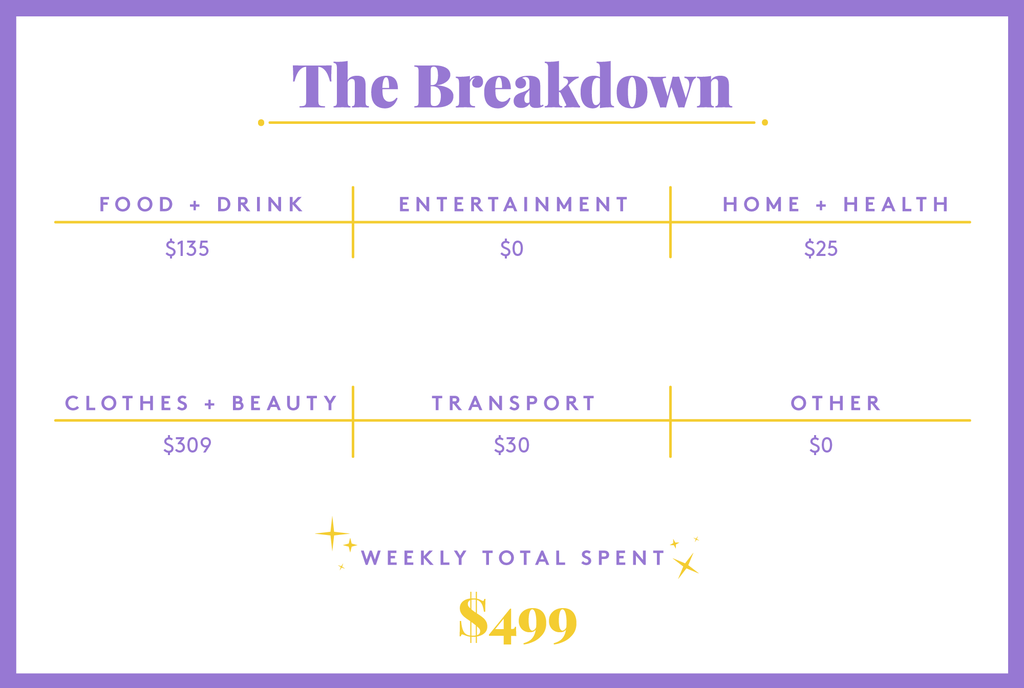

Daily Total: $47

Day Two

10 a.m. — Saturday! B. and I don’t drink coffee, so we don’t have any at the house but my mom needs it… badly. We take a drive to Dunkin’ while B. sleeps and pick up regular coffees for her and an iced matcha latte for me. She generously pays!

1 p.m. — We have another game today, but away, so I head off to catch the bus with my team. B., my mom, and my brother will meet there later, where B.’s dad and stepmom will also be.

5:30 p.m. — I hear laughing and talking from my people during the game, so I take that as a good sign. We lose, but oh well. You win some, you lose some. I don’t take the bus back. Instead, I drive with my family to meet B.’s fam for dinner. We pick a casual place that has room for us and a good menu. We eat a lot, laugh a lot, and have a good time. When the bill comes, B.’s dad picks it up.

10 p.m. — Finally home! Long day but a good one. B., my mom, B.’s brother, and I decide we have enough energy for a game or two of Catan before going to bed. My mom and I both win! Then we turn in.

Daily Total: $0

Day Three

8:45 a.m. — Early wake up today. We’re going to look at a potential wedding venue! It is about an hour’s drive to the venue, so we stop at Dunkin’ first to get donuts and a large coffee for my mom before hitting the road. She pays again.

12:30 p.m. — Wow! We finish the tour at the venue and it looks great. The place is good, the food looks amazing, and they have openings for when we’d want to get married next summer. We ask them to hold the date for the week while we decide to take it or not.

2 p.m. — When we get home, we eat a quick lunch, get my brother, and then hit the road to go apple picking. My family used to go every year and make apple pies with the apples we picked. My sister didn’t come up this weekend, but we still have a fun time collecting different types of apples at this beautiful orchard nearby. We get our money’s worth, stuffing as many apples as possible into the bags provided. After that, we head home to relax before my mom and brother go home. $20

5:30 p.m. — My family leaves and B.’s dad, sister, and her boyfriend come over to hear about the venue and watch the Patriots play. They’ve had a tough season so far, unfortunately. We decide on ordering from our favorite Chinese restaurant. We get pork fried rice, veggie lo mein, crab rangoons, General Tso’s chicken, beef skewers, and one other kind of chicken. B.’s dad pays for dinner again! We chow down while watching the game. Unfortunately, the Pats lose again. Everyone goes home after that, so B. and I relax and get ready for another school week.

10 p.m. — We head to bed after I pick out my outfit and make lunch for tomorrow. This is something I do every night to save some time. I learned that trick when I student taught in college.

Daily Total: $20

Day Four

6:05 a.m. — Another Monday. They aren’t bad, just tough starting the week again. During homeroom, I get hit with a basketball and I have a headache immediately. (I am a PE teacher, so my homeroom is in the gymnasium.)

12 p.m. — Lunchtime! I grab an ice pack and put it on my head, hoping it will help. While I’m eating leftovers, I get an email saying my birth control is on its way. I use Nurx because I haven’t found a good gyno that I like in MA yet. $8

3:05 p.m. — I go home to nap before I have to catch the bus later for an away game. The nap and some Advil helps my head a little. B. goes to the grocery store after work and picks up some basics; milk, eggs, cantaloupe, chicken, cereal, bagels, pasta, pancake mix, bacon, steak, and yogurt. My share is $35. $35

9:30 p.m. — Late night for me. I finally get back from the game, which we won, and eat a late dinner of burgers and salad. It was freezing at the game, so it takes me some time to get warmed up again. My head still hurts, so I go to bed once I get everything settled.

Daily Total: $43

Day Five

6:05 a.m. — Uh oh. My head is still throbbing. I make a note to talk to the school nurse when I see her. Usual routine and head to work.

12 p.m. — Lunchtime. The nurse thinks I may have a concussion and, sadly, I agree. So I spend lunch searching for a few nearby health centers where I can get my head checked out. I get an appointment after work.

4 p.m. — After waiting for over an hour, I finally get checked out. The PA agrees that it’s a concussion and gives me a note saying I don’t have to go to work the rest of the week, because of the increased risk of getting hurt again. I text my mom letting her know, then drive home to tell B. the news.

7:30 p.m. — After all of that, I still have to go get my bridesmaid dress fitted for my best friend’s wedding that is coming up. B. kindly drives me so I don’t have to drive at night and have the lights bother my eyes. The tailor is nice and does what she needs to do quickly. Because they need to rush the alterations, it comes out to $160 to get it to fit me! That is more than what I paid for this dress, but I begrudgingly swipe my credit card because I need this dress. Being a bridesmaid is expensive! B. then drives us home and we watch Only Murders in the Building, which is fantastic. $160

10 p.m. — I go to bed early because my head is killing me, but I’m happy knowing I can sleep in because I’m not going to work. B. watches TV for a little longer and then comes to bed to snuggle before falling asleep.

Daily Total: $160

Day Six

10 a.m. — Wow, did it feel nice to sleep in. I eat breakfast and take some Advil before getting dressed. I have a few quick errands I want to run before my head gets worse. I stop for gas first and fill up for $30. $30

10:30 a.m. — After getting gas, I head to the grocery store to pick up some supplies to make apple pie. I do it quickly because I’m starting to feel bad again. It’s $20 total, but B. splits it with me. $10

11 a.m. — I put the groceries away and take a long nap to rest my brain a bit. After waking up, I eat a PB&J and start making the pie. I use the same recipe that my mom uses because I think it is the best one out there! She makes a nice crumble top that really puts this pie over the edge. I lie down again after the pie is done.

4 p.m. — B. comes home from work and we talk about our days while lying on the couch. We remember that we have a wedding reception to go to this weekend where wearing costumes is encouraged. We scroll through Amazon a bit before deciding on Ash Ketchum and Pikachu costumes that will come in the next day. We each pay for our own. I am ready to be the most comfortable person at the party. $41

9 p.m. — B. goes to the movies with a friend of ours and I decide to stay home and rest. I buy a case of Celsius packets because they are cheaper than the cans and I like having them for work when the days drag on. When B. gets home, he talks about the movie, then we watch some TV before heading to bed to snuggle. $11

Daily Total: $92

Day Seven

10 a.m. — While B. is at work, I shop online to get some new fall clothes and a pair of heels for the wedding I’m in. My credit card gives me cash back on Lulu’s so I shop there and find what I need. I get a pair of heels, a new belt, a sweater, and a bodysuit. I don’t wear bodysuits, but I figure it could be interesting to try one. $108

12 p.m. — I nap on and off while B. is at work. I muster up the energy to take the summer clothes out of my closet and put my fall/winter clothes in there. My head is feeling better than it has been, so I take that as a win.

4 p.m. — B. stops at the grocery store on his way home and picks up some stuff for dinner and some other goodies. He is a great cook and he makes chicken tikka masala with basmati rice and naan, which I am more than happy to eat. We eat and enjoy each other’s company since we have the house to ourselves; B.’s brother, who has been staying with us, is out West visiting their other sister for two weeks. We watch some football and root for the players we have on our fantasy teams and then head to bed for some alone time. Afterwards, we sit and relax, talking about life and what our wedding could look like. $29

Daily Total: $137

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Queens, NY, On A $67,000 Salary

A Week In Portland, OR, On A $43,600 Salary

A Week In Boston, MA, On A $95,000 Salary

DMTBeautySpot

via https://dmtbeautyspot.com

Refinery29, DMT.NEWS, DMT BeautySpot,

0 comments